As we prepare for the new Chinese Year of the Horse, 2026 so far has shared its characteristics of strength and prosperity. From a macro perspective, the global economy continues to show resilience; fiscal stimulus and accommodative monetary policy remain supportive, energy prices are low, the dollar has weakened, and inflation appears broadly under control. Wage growth is moderating, services indicators are under some pressure and tariffs have eased despite ongoing headline rhetoric.

Global growth forecasts have also ticked up. The latest World Economic Outlook, released last week, shows that GDP is expected to rise 3.3% this year (up from 3.1% in October) with upward revisions for both advanced and emerging market economies[1].

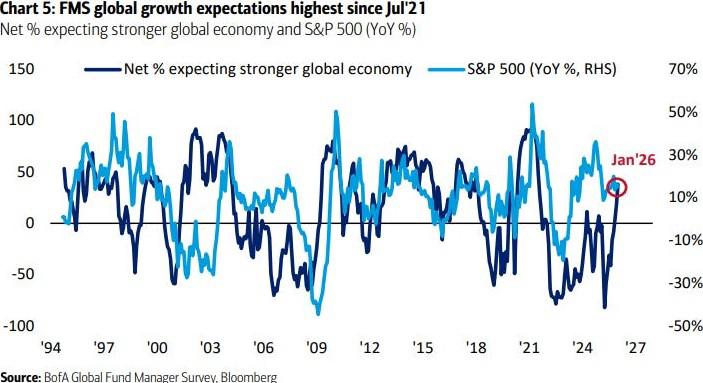

This economic optimism is shared by investors. The latest Bank of America Global Fund Manager Survey last week revealed that a net 38% (up from 18% in December) of respondents expect stronger global growth over the next 12 months – the highest reading since July 2021. At the same time, only 9% of fund managers surveyed predict a recession – a four-year low – and the proportion expecting a “boom” has risen to around 34%, the highest since September 2021.

Stock markets shrug off rising volatility

The positive economic outlook is also reflected in stock market performance. Global equities rose 1.9% in EUR in January (-1.4% in NOK), with cyclicals, value stocks and small caps benefiting. Market leadership beyond a narrow set of growth names has also continued to broaden in 2026 with the MAG 7 companies delivering flat year-to-date returns amid greater investor scrutiny of their huge CAPEX spending[2].

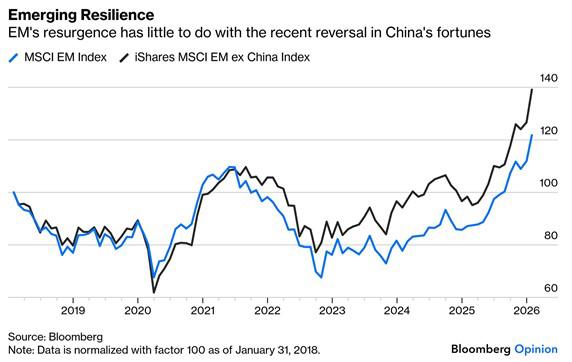

Also notable is the continued strength of emerging markets, which outperformed developed ones significantly in January. The MSCI EM Index is now trading at a record high, surpassing its previous post-Covid peaks with returns broadening beyond China –historically the engine of EM performance (see chart below) – to markets like Korea and Taiwan. SKAGEN Kon-Tiki’s outperformance also continued in January as the fund gained 9.0% in EUR (5.5% in NOK) – you can read more about its successful 2025 trading activity in these countries in a recent Bloomberg interview.

Another feature of 2026 has been rising market volatility. News headlines remain unsettling with elevated geopolitical tensions centred on the US’s intervention in Venezuela, renewed friction surrounding Greenland and unrest in Iran. Despite these developments, the VIX index (or ‘fear gauge’) remains below 20, in line with its long-term average and at a level that does not normally indicate any major short-term threats. Looking further out, however, it is notable that January’s Bank of America global fund manager survey revealed ‘geopolitical conflict’ has now become the top tail risk among investors at 28%, overtaking fears of an ‘AI bubble’ which now ranks second at 27%.

Reasons for optimism

As the US retreats from its governance role on the world stage, many commentators are looking at Europe to step up, while the region also seeks to forge new trading relationships in the face of American tariff uncertainty. Last week, the EU agreed an important trade deal with India that will reduce tariffs on around 97% of exports – equivalent to saving €4bn. This followed a similar agreement earlier in January with the Mercosur countries that creates a large free-trade area with Argentina, Brazil, Paraguay and Uruguay to lower tariffs on industrial goods and secure access to raw materials that should boost European trade beyond traditional US partners. European equities were among the biggest climbers in January with the Stoxx Europe 600 index rising over 3%.

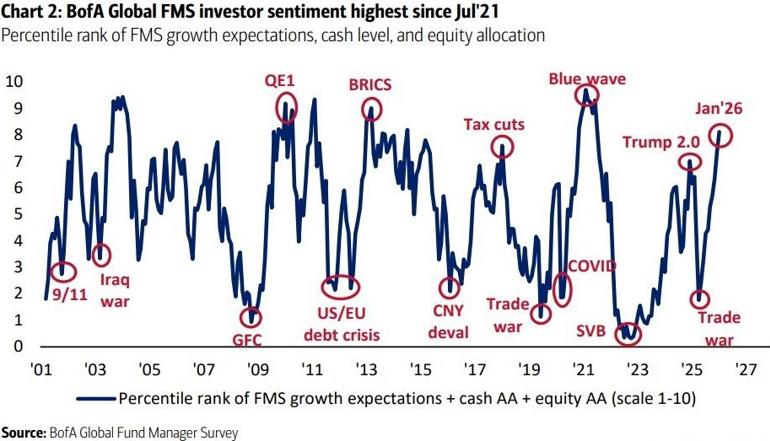

Amid the market broadening in January, US equities remained strong if not spectacular, with the S&P 500 breaking 7,000 for the first time ever and posting a solid 1.2% gain. Since 1950, when the first month of the new year has been positive, the index return over the next 11 months has also been higher 87% of the time. With the US market still representing 64% of the global index, this would likely be positive for global equities in 2026. Indeed, the headline sentiment composite of the Bank of America Fund Manager Survey, which combines equity allocation with global growth expectations, and cash levels, rose to 8.1 from 7.3, the highest since July 2021 and a sharp recovery since its ‘Liberation Day’ lows in April last year.

Contrarian thinking

For contrarian investors like us, such positivity can often be a red flag. It may be helpful, therefore, to remind readers how our investment philosophy guides portfolio decisions. Our focus remains firmly bottom-up, driven by fundamental company research rather than short-term macro or political noise. We continue to prioritise strong balance sheets, robust cash flows and clear margins of safety – investing, as always, with one eye on the upside but the other firmly focused on downside risk.

Portfolio construction across our funds remains disciplined and diversified, not in reaction to headlines, but as a deliberate way to manage dangers we cannot predict while concentrating capital where conviction is highest. Turnover remains measured, reflecting our long-term orientation and willingness to stay patient when valuations, rather than sentiment, drive opportunity.

In a few days we will publish our fund’s monthly reports for January to illustrate how the portfolio managers have sailed these waters at the start of 2026 and how their funds are positioned to navigate the months ahead.

-----

[1] Source: IMF World Economic Outlook, January 2026.

[2] Source: Bloomberg Magnificent 7 Total Return Index.