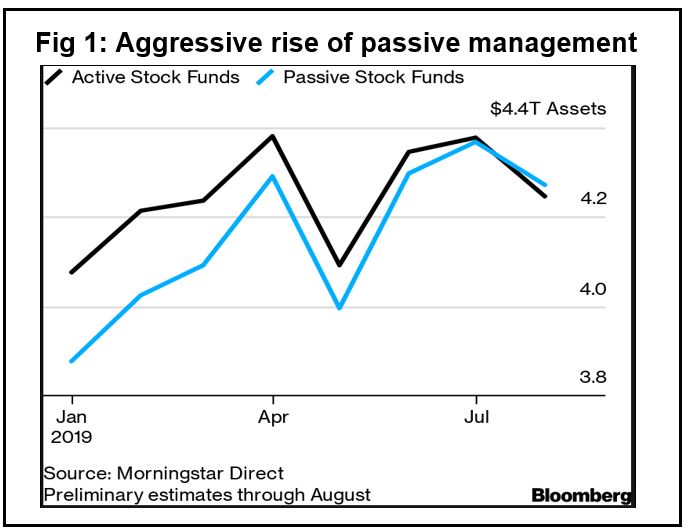

The growth in passive investing has arguably been the single biggest stock market development for a generation. Assets in funds designed to track the US equity market – comfortably the world’s largest – have doubled in size over the past decade and overtook those managed actively for the first time during the summer (see figure 1)[1].

While passive management has undoubted benefits and can play a role in a well-balanced portfolio, stock pickers still have a lot to offer. Here are the top ten reasons why active is still attractive.

1. Exploit market inefficiency

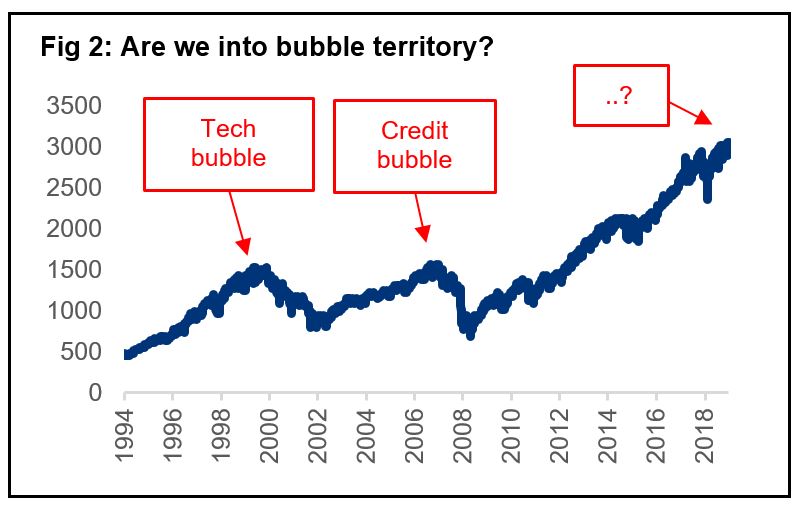

Passive investing assumes markets are 100 percent efficient and participants act logically with access to the same information, all of the time. Of course this can’t be true, otherwise bubbles and crashes wouldn’t occur. None of us are consistently rational – we have all made purchases that we’ve later regretted – and stock markets are no different. By using research analysts and expert company knowledge, good stock-pickers can exploit the pricing anomalies created by emotional biases and information failures to work in your favour.

2. Niche market advantages

Index funds need certain features in the markets they track to function effectively, such as low trading costs and liquidity. Active managers, on the other hand, thrive in the least efficient corners of the market where flexibility and knowledge are more important than size. Emerging markets is an example where information can be harder to find, companies are less well-researched and expertise is needed to find the best ideas. Indices can also exclude frontier markets and preference shares where the rewards are often greatest. A 2017 study[2] of 126 emerging market funds found that stock pickers delivered returns of 31.8 percent after fees over a ten-year period, compared to 7.7 percent for a passive alternative. Another niche is smaller companies, which may be attractively valued and fast growing but omitted from indices biased towards large-caps.

Active managers thrive in the least efficient corners of the market where flexibility and knowledge are more important than size.

3. Better resource allocation

By tracking market-cap weighted indices, passive investing can encourage the inefficient allocation of resources by deploying capital towards the biggest firms, rather than those generating the best returns. As well as creating bubbles, this is wasteful for the economy and is particularly a problem in emerging markets where the largest companies are often sub-optimally run state-owned enterprises and environmentally unfriendly energy or commodity companies.

4. Stewardship

It is the fiduciary duty of active managers to act in the best interests of their clients, typically by investing in a small number of companies that they believe are undervalued. Because stock-pickers usually make sizeable investments in each portfolio company, it is vital to engage with them in a positive way to unlock their potential and safeguard clients’ money. There may be issues with strategy, management, environmental, social and governance factors, for example, where active owners can assert their influence to drive positive change which benefits shareholders and other stakeholders.

5. Higher returns

Ultimately, money talks and most research shows that true stock pickers deliver the best financial returns. An influential study[3] which used the concept of Active Share to assess returns over a 20-year period, found that the most active managers outperformed their benchmarks by 1.3 percent annually after fees whereas “closet indexers” unsurprisingly performed worst, lagging the benchmark by around 0.9 percent a year. A comprehensive academic review[4] earlier this year supported these findings, with the authors stating: “We conclude that the academic literature over the past 20 years shows that active managers have a variety of skills and, in many cases, tend to make value-added decisions. In other words, many funds do appear to create value for investors even after accounting for fees. While many challenges remain, we believe the conventional wisdom fails to account for the more positive findings of recent research on active manager skill.”

6. Value for money

On the issue of fees, it’s hard to deny that passive funds are cheap, but they should be. Who would want to pay a high price for an average product which is designed to underperform the market after fees? In fact, 85% of passive funds underperform according to a 2018 study which looked at 12,000 funds over a ten-year period. Investors should focus instead on performance, particularly as active fund fees generally have fallen by over 25% since 2000[5]. As the report’s author, Jim Atkinson, concluded: “The opportunity cost for seeking average can be extremely high.”

7. Risk management

While higher returns typically involve greater risk, passive investors have complete exposure to the movement of the stock market they are tracking, both up and down. Given that index funds operate with very low margins, their success has been built on effective marketing campaigns to attract greater volumes of capital. This needs to find liquidity and is increasingly driving large companies to very high valuations, which may be difficult to defend at some point in the future. With many global stock markets at record levels and growing economic concerns, you should ask whether there will be sufficient liquidity when the rubber hits the road.

Unlike active management, passive investing removes price discovery. Most index funds allocate capital based on company size, rather than investment credentials, thereby automatically over-weighting expensive shares and under-weighting cheap ones, which fuels the creation of bubbles. A Norwegian example is Opticom, which all major bank-owned mutual funds were forced to own following its stock market listing twenty years ago. The technology company’s share price and valuation continued to rise until the tech bubble burst and large losses ensued (see figure 2).

8. Flexibility

Active funds, in contrast, had relatively little exposure and generally did very well when the internet bubble burst. Having the flexibility of a broad mandate, rather than being tied to a particular index, means they can not only pursue attractive inefficiencies across the whole universe of listed companies, but also avoid markets which are overheating. We all appreciate choice as part of our purchase decisions and investment should be no different; the global stock market is huge (the Norwegian oil fund alone invests in around 17,000 companies) so why restrict yourself to a narrow region or sector?

9. High conviction in best ideas

As well as a larger investment universe, active managers can choose how much to invest in a particular company, unlike passive funds where holding size is dictated by a company’s market capitalisation. The diversification benefits of adding stocks to a portfolio can be quickly outweighed by additional trading costs and stock pickers tend to generate the best returns by investing with conviction in their best ideas. A 2010 study[6] found that active managers’ largest holdings consistently outperformed the market and their lower conviction positions by 1.2-2.6 percent per quarter. A similar conclusion was found by research in 2012[7] which examined 4,700 US equity funds over a ten-year period and found that the more concentrated a portfolio, the better its performance.

10. Long-term thinking

A further benefit afforded to active managers is the opportunity to think long-term. This minimises trading costs and recognises that many triggers for share price appreciation occur over time and patience can be key to maximising returns. With average holding periods falling as market participants increasingly overreact to good or bad news, time arbitrage is perhaps one of the best market inefficiencies that active managers can exploit. Research[8] on US funds from 1990 to 2013 illustrated that funds with high levels of both active share and patience – defined as an average holding period over two years – outperformed by over 2.0 percent per year, net of fees.

In conclusion, we believe there are at least ten good reasons to choose active management as a core part of your investment strategy. Ironically, as more assets continue to flow into funds looking to replicate a benchmark, either explicitly or secretly via closet indexing, opportunities increase for truly active managers to exploit the market inefficiencies it creates. So, how do you give yourself the best chance to pick a winner? Start with funds that are truly active; while high active share doesn’t guarantee a fund will outperform, it is a necessary condition for outperformance. By then selecting those with high conviction and a long-term perspective, you can only increase your chances of success.

References

[1] Source: Bloomberg

[2] Source: Copley Fund Research, 2017

[3] Active Share and Mutual Fund Performance, Petajisto, 2013

[4] Challenging the Conventional Wisdom on Active Management, Cremers, Fulkerson and Riley, 2019

[5] Source: Morningstar Direct as at 31/12/2018

[6] Best Ideas, Cohen, Polk and Silli, 2010

[7] Diversification versus Concentration… and the Winner is?, Yeung, Pellizzari, Bird and Abidin, 2012

[8] Patient Capital Outperformance: The Investment Skill of High Active Share Managers Who Trade Infrequently, Cremers, 2015