As stock pickers, SKAGEN Kon-Tiki focuses on companies with the portfolio constructed bottom-up but sensibly diversified across geographies, sectors and other top-down risk factors. Based on the managers’ selection of the companies offering the best risk-reward at a particular time, themes can emerge and the portfolio is currently 70% invested in stocks from China, Korea and Brazil.

Common attractions

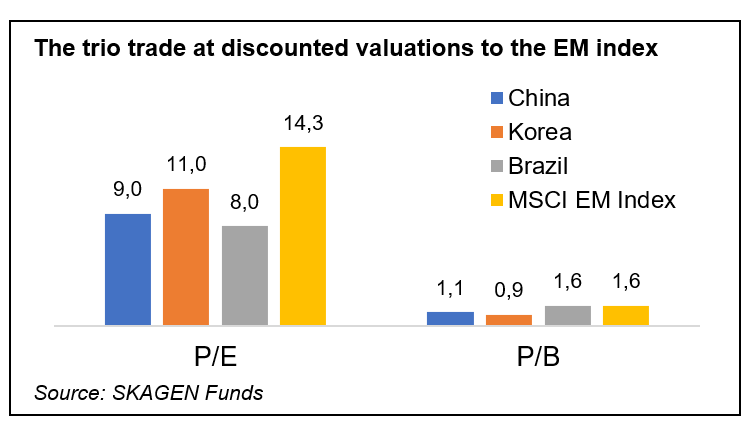

Despite many differences, the three countries share features that are attractive from an investment perspective. For value-based investors such as SKAGEN, the first is that they appear undervalued. “On multiples of earnings and book value, China, Korea and Brazil offer better value than the EM universe and relative to their own historic averages. Valuation remains one of the key drivers of long-run return, so the starting point for each country from a pricing perspective is compelling,” explains Fredrik Bjelland, Kon-Tiki’s Lead Portfolio Manager.

Another common theme is that they are all geographies where active management can add value. “Each is home to world class companies but there are also challenges in terms of ownership structures, government intervention and other risk factors. There are many companies to choose from – the MSCI China Index alone has over 750 constituents – and stock selection can make a big difference to investment return,” adds Bjelland. This was illustrated last year when Kon-Tiki’s Chinese holdings outperformed the MSCI China index by nearly 20 percentage points, gaining 5.4% in a market that fell 13.9%[1].

China, Korea and Brazil are also currently undergoing significant changes, as Bjelland explains: “Each country has entered a period of transition – either stabilisation, reform or improving economic fundamentals. This is exciting for EM investors generally and these developments will help drive Kon-Tiki’s performance over the next six months to two years.”

China stabilisation

China is Kon-Tiki’s largest country exposure at 30% of assets, compared to around a quarter (26%) for the EM index – only the second time in the fund’s 22-year history that it has been overweight in China. Kon-Tiki also has above-average exposure relative to other EM funds with many investors turning their back on the country in the face of economic and regulatory challenges that have left Chinese equities trading 30% below their 30-year average P/E ratio and at a record 60% discount to those in the US[2].

Consensus estimates are for company earnings to grow 14% this year but Bjelland believes that it only requires the landscape to stop getting worse for investors to see better returns: “Although not a major source of company financing like in the US, for example, China’s equity market is important for perception. After losing almost half its value in three years, the authorities have seen enough and said that they will take more forceful measures to stabilise the stock market.”

The Chinese government has tightened short selling rules and proposed a $278bn rescue package to boost market confidence. China has been a happy hunting ground for Kon-Tiki recently despite the market slide. With more stable conditions – the Shanghai Composite Index is up 12%[3] since the start of February and recent data suggests the economy is also stabilising – Chinese companies could become an even more important source of value creation for clients.

Korean Value Up

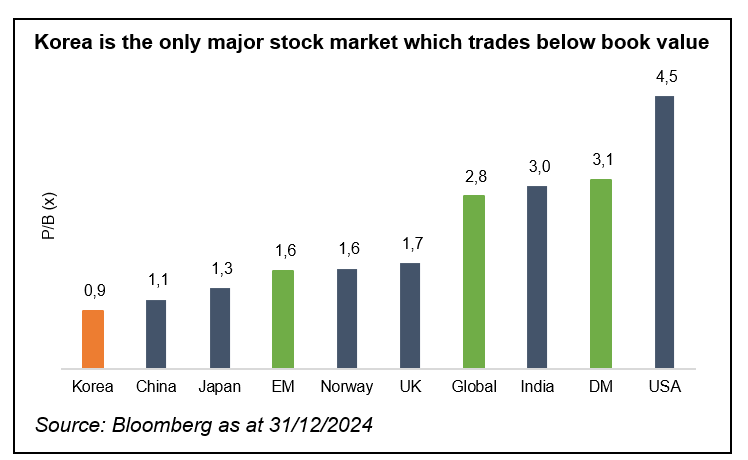

Kon-Tiki’s second largest country exposure is Korea, where a quarter (25%) of assets are invested, compared to 13% of the index. Companies there have long suffered from a ‘Korea Discount’ linked to weak corporate governance and minority shareholder protection, particularly in large family-controlled conglomerates. “Until now these families have pretty much been allowed to do what they pleased,” explains Bjelland. “The Korean tax system has also treated retained earnings more favourably than dividends and encouraged family-owned businesses to suppress company value in order to minimise inheritance tax.”

Minority shareholder protection has become a political issue as share ownership among the Korean population has grown. “Investing in the stock market exploded during COVID and there are now almost as many investors in Korea as homeowners. In an election year, the government recognised that it would be political suicide not to act,” explains Bjelland, “and so in January launched its Value Up initiative”.

This programme pushes company directors to analyse cheap valuations and establish strategies to address them. It follows a similar initiative in Japan where companies that failed to boost book value were ‘named and shamed’, triggering a successful re-rating of many stocks, notably in the banking sector where valuations had been particularly depressed.

Korean banks have come under recent pressure from Align Partners, a local activist investor whose campaign to improve corporate governance and capital allocation we have supported. “The Korea Discount has always been particularly wide in the banking sector as lenders have been encouraged by the government to grow their loan books rather than return money to shareholders, “explains Bjelland, “banks also don’t have dominant shareholders – unlike many Korean corporates – which gives us the best chances of success.”

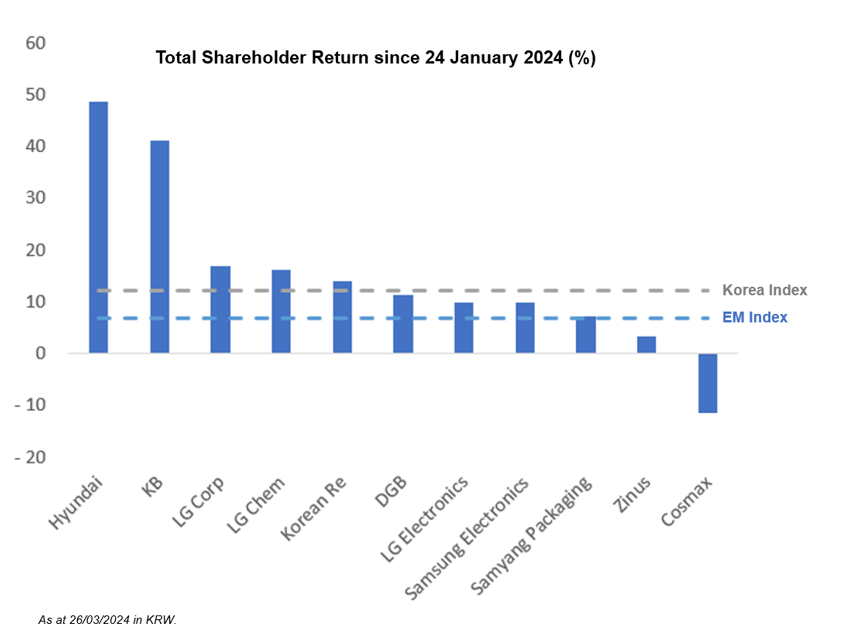

The weight of different stakeholders pushing for change has already had a positive effect on Korean companies. Since the Value Up programme was announced the KOSPI has climbed 12%[4] while the Korean Bank Index is up over 25% since the start of the year[5]. If the changes have the same positive effect as Japan, where the Nikkei 225 has risen over 25% since its name and shame regime was announced in October, shareholders should expect further gains[6].

Brazilian easing

Brazil, Kon-Tiki’s third largest country exposure at 17% of AUM (versus 5% for the EM index) is on the cusp of positive economic changes. Inflation has fallen from 12% in the summer of 2022 to below 5% thanks to aggressive monetary policy tightening but interest rates have now started to fall.

“The Brazilian SELIC target rate has come down from around 14% last summer to below 11%, and we expect further easing to provide a tailwind as inflation seems to be under control,” explains Bjelland, “we are also entering a more positive phase of the agricultural cycle, which should benefit the economy and the cross-section of Brazilian holdings that we own.”

Like China and Korea, Kon-Tiki is overweight in Brazil relative to its historic average exposure as well as the index. “For value investors, price and change are the key ingredients to produce positive investment returns, “concludes Bjelland, “these three countries are cheap on many measures, which is a great starting point, but also undergoing shifts in sentiment, governance and economic factors that should help drive shareholder value.”

[1] Source: SKAGEN and Bloomberg (total return gross of fees in EUR)

[2] Source: JPM Morgan Guide to the Markets, as at 29/02/2024.

[3] Source: Bloomberg 05/02/2024 – 26/03/2024.

[4] 24/01/2024 – 26/03/2024.

[5] KRX Bank (KRXBANK) in KRW as at 26/03/2024.

[6] Nikkei 225 15/10/2023 – 22/03/2024.