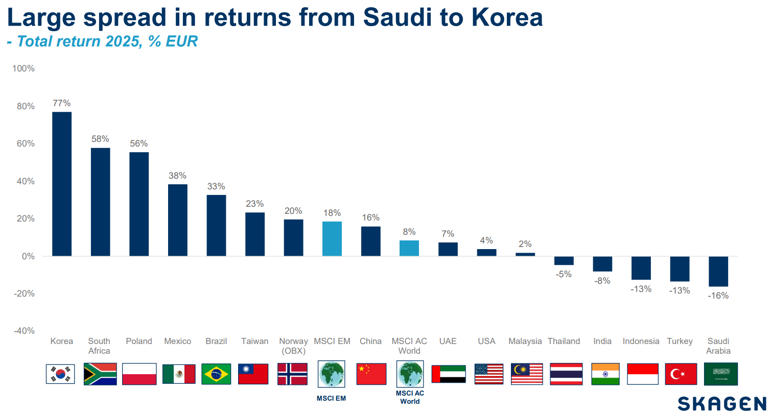

In a good year for risk assets generally, 2025 was very positive for emerging markets in both absolute and relative terms. The MSCI EM Index rose 34% in USD to deliver its best return since 2017 and a new all-time-high and beat the MSCI World Index of developed markets by 12% following two years of underperformance[1].

These gains were driven by strong performance from large Asian markets, namely China, Taiwan and Korea, with the latter boosted by structural reforms and a strong cyclical upswing in the technology sector. The commodities boom lifted South Africa, Mexico and Brazil, whereas Saudi Arabia was weighed down by a falling oil price and India de-rated after several years of strong relative performance.

SKAGEN Kon-Tiki also had its best year for some time in both absolute and relative terms. The fund returned 28% in EUR after fees, 10% ahead of the benchmark which it also leads over 3- and 5-year periods, as well as since inception. Performance was helped by its Korean exposure (23% of the portfolio versus 16% of the EM index[2]) with Samsung Electronics and Hana Financial among its top five contributors. Good stock picking in China meant that Alibaba and Ping An were also in the list, as well as TSMC from Taiwan.

Positive portfolio positioning

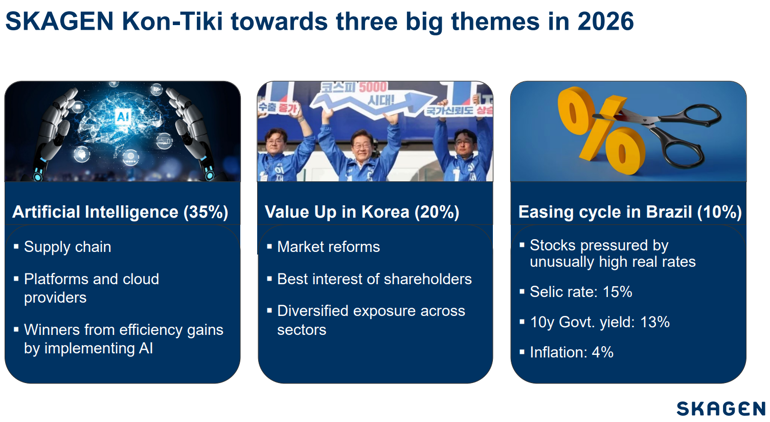

Emerging markets’ strong performance has carried into 2026, driven by continued momentum from semiconductor stocks in Korea and Taiwan plus a rebound in Brazil, and SKAGEN Kon-Tiki’s portfolio is well-positioned for these themes.

Both Korea (10x P/E) and Brazil (11x P/E) also have the attraction of valuations that offer good upside potential with downside protection. Emerging markets generally (13x P/E) are valued in line with historic averages following their recent rally, although they remain heavily discounted versus developed markets (19x) and the US (22x), in particular[3].

Kon-Tiki’s strong performance has seen many of its holdings achieve price targets in recent months and there has therefore been a relatively large amount of portfolio activity. 10 companies have exited the fund since the start of 2025 and 14 have entered, leaving the fund with 48 holdings at the start of February.

This sell discipline means that the fund trades at a ~40% discount to the broader market on both earnings and book value multiples, with ~30% upside based on price targets over the next two to three years. The portfolio also retains its quality characteristics with superior return on equity (ROE) versus the benchmark.

With long-term structural EM drivers still compelling in terms of economic growth and demographics while valuations remain at attractive discounts to developed markets, the recent resurgence in EM equities looks to have further to run. Alongside shifts in consumption, technology, geopolitics and global trade patterns, these tailwinds should continue to provide attractive opportunities for value-focused stock pickers like SKAGEN Kon-Tiki.

Click here to watch a recording of the fund update with Lead Portfolio Manager, Fredrik Bjelland: Market update with SKAGEN Kon-Tiki - YouTube

------

[1] Source: MSCI. MSCI EM Index factsheet

[2] As at 31/01/2026

[3] Source: Bloomberg. Forward P/Es as at 05/02/2026