- Stocks globally, particularly in the banking sector, have been volatile in the last week due to issues at individual banks and concerns over their implications for the health of the international financial system.

- SKAGEN has no direct exposure to the specific banks in trouble and our funds' exposure to the banking sector is generally less than or in line with their benchmark indices.

- The banks we hold are well capitalised and managed, and we are confident that the risk of contagion is low.

Silicon Valley Bank

Last Friday saw the closure of Silicon Valley Bank (SVB), a US bank which served business customers from the venture capital and technology communities mainly in the US but also overseas. A combination of poor management and weak corporate governance meant that SVB had insuficient risk diversification, both in its client base – a relatively small number with large uninsured deposits – and its investment portfolio which was susceptible to rising interest rates.

US regulators forced SVB to close on Sunday as its customers lost faith in the bank's ability to look after their money and sought to withdraw their deposits all at once. To prevent wider concern regulators guaranteed all customer deposits after SVB's collapse (it did the same for Signature Bank which had ties to the cryptocurrency industry and collapsed after facing a similar 'run' from depositors), leaving shareholders to bear the brunt. None of SKAGEN's funds owned shares in SVB or Signature Bank.

Credit Suisse

This week problems surfaced at Credit Suisse, which lost around a quarter of its value after its largest shareholder, Saudi National Bank, ruled out financial support. This came after the Swiss bank's auditor identified “material weaknesses” in its financial reporting controls which led to the publication of its annual report being delayed.

Credit Suisse has suffered a series of high-profile scandals linked to management and governance failures akin to SVB, which have put downward pressure on its valuation for some time. On Thursday, it recovered most of this week's share price losses after agreeing a SFr 50 billion loan with the Swiss central bank in an attempt to boost liquidity and calm investors. None of our funds own shares in Credit Suisse.

Contagion fears exaggerated

The troubles at banks on both sides of the Atlantic have sparked concern over the health of the wider banking sector. The KBW Index of US banks has lost around 20% in five days and the European equivalent is down around 10%[1]. This has had implications for stock markets more broadly, both in terms of their size (banks represent 9% of the global index and 16% of emerging markets) and confidence in the international financial system.

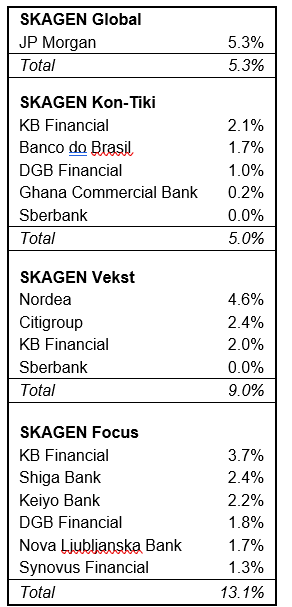

Our funds generally are either underweight banks or have similar exposures to their indices (see table of holdings below). We do do not believe that there will be any significant contagion for a number of reasons. First, regulations have massively increased since the 2008 global financial crisis resulting in banks being much more robust and better capitalised. Second, the issues at SVB and Credit Suisse are specific to the individual banks rather than indicative of weakness in the financial system. Finally, the US and Swiss authorities' actions have shown that central banks are ready to step in if needed.

We are confident that our bank holdings are well capitalised, run by good management teams and have strong corporate governance systems in place. This is a benefit of active management – picking stocks on the basis of thorough research. We will continue to monitor the situation across the banking sector closely and keep you updated via our webiste and the funds' monthly reports.

I discussed the banking sector volatility and other issues in a recent CIO market update.

SKAGEN's bank holdings as of 28/02/2023

[1] Euro Stoxx Banks Index