The content on this page is marketing communication

Programme 12 January 2021

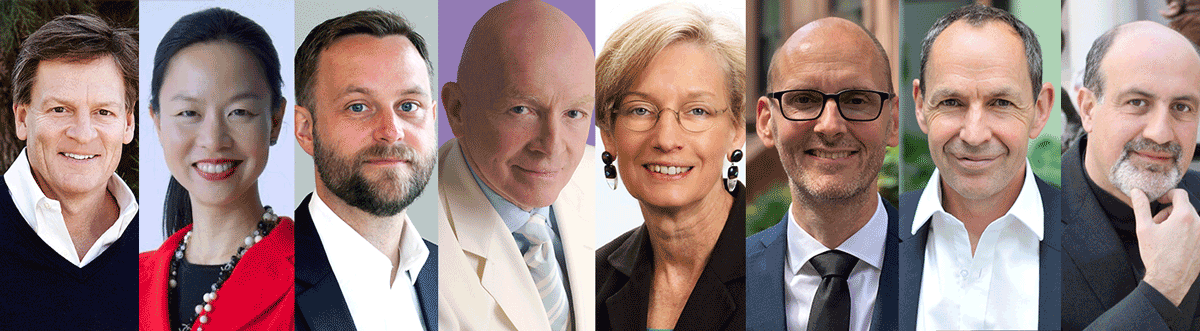

08.30–08.35 Introduction, Siri Lill Mannes, moderator

08.35–08.45 Welcome, Tim Warrington, CEO SKAGEN

08.45–09.30 Risks in the financial system, perspectives on the US economy, Michael Lewis, author and journalist*

09.30–09.45 BREAK

09.45–10.30 Investor panel: Monica Hsiao, founder and CIO, Triada Capital, and Fredrik Bjelland, portfolio manager SKAGEN Kon-Tiki

10.30–11.00 Governance and sustainability in Emerging Markets, Mark Mobius, Founding partner Mobius Capital Partners

11.00–11.15 BREAK

11.15–11.45 Post Covid economy - rebound or recovery? Catherine L Mann, global chief economist at Citi

11.45–12.15 Outlook on financial markets, Torsten Slok, chief economist at Apollo

12.15–12.45 BREAK

12.45–13.15 There is no planet B – implications for investors, Mike Berners-Lee, carbon consultant and author

13.15–14.00 The Covid crisis is not a Black Swan, Nassim Taleb, risk specialist

Ca 14.00 end of conference

*Please note: The visual and/or audio content of Michael Lewis' session or any part thereof may not be recorded, broadcast, televised, published, photographed, copied or in other ways reproduced, distributed or shared in writing, by video or audio.